Tel:400-0058-999

Add:No. 2200, Section 3, South Street,Wafangdian City, Liaoning Province, China

Tel:0411-85647733

Fax:0411-85647666

Website:www.xzjcmc.com

Kaman Reports 2016 Fourth Quarter and Full Year Results

Release Time:01 Mar,2017

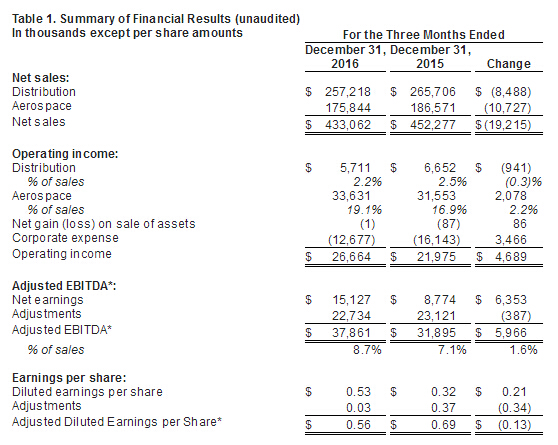

BLOOMFIELD, Conn.--(BUSINESS WIRE)-- Kaman Corp. (KAMN) today reported financial results for the fourth fiscal quarter and full year ended December 31, 2016. Neal J. Keating, Chairman, President and Chief Executive Officer, commented, “In the fourth quarter of 2016, we continued to execute on our key strategic initiatives to position Kaman for profitable growth. Against a challenging macroeconomic backdrop in certain of our end markets, we are successfully executing on our productivity and realignment programs to enhance margins and consistently deliver improved financial performance. As a key highlight, we are pleased to report gross margin of 31.3% for the quarter, a 310 bps increase over the fourth quarter of 2015 and a 140 bps increase over the third quarter of 2016, primarily driven by improvements at Distribution. Demonstrating our focus on driving meaningful cash flow generation, 2016 was the third consecutive year in which Free Cash Flows* were greater than 130% of our Net Earnings.

Sales in our Distribution segment continued to be impacted by ongoing weakness in our end markets resulting in a 3.2% decrease as compared to the same period last year. Organic Sales per Sales Day* decreased 4.9% for the fourth quarter when compared to the same period last year and declined 3.0% sequentially.

Distribution operating margins in the quarter were 2.2%, a decrease of 30 bps compared to the same period last year. Importantly, this decrease includes the costs associated with the deployment of productivity initiatives designed to expand operating margins, which totaled $4.6 million for the fourth quarter and $12.6 million for the full year 2016. Excluding these costs, Distribution operating margins increased despite lower daily sales levels, which we believe underscores the merits of the actions we are taking. We expect to fully realize the benefits of our productivity initiatives, with significantly lower deployment costs, beginning in 2017.

Our Aerospace segment performed largely in line with our expectations. Sales declined modestly in the fourth quarter; however, sales for the full year increased 17.5%, or 6.9% organically, when compared to the prior year. Strong demand for our missile and bomb fuze products drove organic growth while our bearings products delivered another solid performance throughout 2016. Looking ahead, we will continue to pursue new business opportunities for our fuze products in international markets, where demand remains robust. Aerospace operating margins increased 220 bps when compared to the fourth quarter of the prior year due to improved performance on our structures programs and the contribution from our bearings products.

Prudent, value enhancing acquisitions that strengthen our technology leadership and expand the scope of our product offerings remain a core element of our growth strategy, and we are pleased to report positive performance for our most recent additions. Our acquisitions of EXTEX and GRW continue to perform above expectations and made significant top line contributions while being accretive to earnings per share for the fourth quarter and the full year."

Chief Financial Officer, Robert D. Starr, commented, "In 2016 we delivered strong operating performance and continue to position Kaman for future growth. During the year, we invested $30 million in our operations through the purchase of property plant and equipment, repaid over $20 million in debt, reducing our Debt to Capitalization* ratio by 240 bps to 42.3%, and increased our cash on hand by $25 million. Our robust financial position continues to provide us flexibility to deploy capital to drive value for our shareholders, and in 2016, we returned approximately $33 million of cash to shareholders through our stock repurchase program and dividend payments.

Turning to our 2017 outlook, we expect Aerospace to drive a significant portion of our top line growth, despite continued pricing pressures. We anticipate Aerospace sales increasing in the range of 3.0% to 8.0%, with operating margin in the range of 16.5% to 17.0%. Full year 2017 Aerospace performance is dependent on a number of factors, including the receipt of governmental approvals for direct commercial sales of the JPF to foreign militaries, additional K-MAX orders and continued improvement in the performance of our metallic and composite structures programs.

At Distribution, we expect that 2017 sales levels will range from a decrease of 1.0% at the low end of our range to an increase of 4.0% at the high end, with operating margins in the range of 4.9% to 5.3%. In 2017 we are focused on a return to organic sales growth and are taking necessary actions to achieve this objective, while maintaining disciplined cost control across the segment. Additionally, we expect to more fully realize the benefits of the productivity initiatives we implemented last year as we expect the associated costs to decrease significantly. We are pleased with the meaningful benefit these initiatives have delivered to date and are confident in our ability to achieve further operating margin improvement at Distribution in 2017.

To provide insight into the cadence of earnings for the year, we anticipate a significant portion of our expected earnings will be weighted toward the second half of the year, with first quarter earnings representing less than 10% of our full year earnings. As we move through 2017, we expect earnings to increase sequentially with approximately 50% of our full year earnings occurring in the fourth quarter of 2017 as we anticipate a ramp-up of deliveries for the JPF and our bearings products throughout the year. As previously noted, the delay in receipt of U.S. Government approvals shifted JPF DCS deliveries out of 2016 and into 2017. Further impacting the earnings cadence, we expect that our JPF production capacity for the first nine months of the year will be largely utilized to fulfill our USG contract delivery requirements for 2017. Accordingly, we now anticipate that our higher margin JPF DCS deliveries will mostly occur during the fourth quarter of 2017.

We expect cash flow performance to remain strong in 2017, with cash flows from operations in the range of $105 million to $135 million and Free Cash Flow* in the range of $70 million to $100 million. Given our stable and consistent cash flow generation of the last several years and the expected growth in 2017, we are pleased to announce an 11% increase in our quarterly dividend to $0.20 per share. Kaman has paid a dividend for forty-seven consecutive years, and when combined with our stock repurchase program, underscores our commitment to returning a significant amount of cash to our shareholders."

2017 Outlook

Our 2017 outlook is as follows:

Distribution:

Sales of $1,100.0 million to $1,150.0 million

Operating margins of 4.9% to 5.3%

Depreciation and amortization expense of $16.0 million

Sales of $1,100.0 million to $1,150.0 million

Operating margins of 4.9% to 5.3%

Depreciation and amortization expense of $16.0 million

Aerospace:

Sales of $720.0 million to $760.0 million

Operating margins of 16.5% to 17.0%

Depreciation and amortization expense of $23.0 million

Sales of $720.0 million to $760.0 million

Operating margins of 16.5% to 17.0%

Depreciation and amortization expense of $23.0 million

Interest expense of approximately $16.0 million

Corporate expenses of approximately $55.0 million

Estimated annualized tax rate of approximately 34.5%

Consolidated depreciation and amortization expense of approximately $45.0 million

Capital expenditures of approximately $35.0 million

Cash flows from operations in the range of $105.0 million to $135.0 million; Free Cash Flow* in the range of $70.0 million to $100.0 million

Weighted average diluted shares outstanding of 28.5 million

Dividend Increase

The Kaman Corporation board of directors has declared a regular quarterly dividend of 20 cents per common share, representing an 11% increase, which will be paid on April 6, 2017 to shareholders of record on March 21, 2017.

Please see the MD&A section of the Company's SEC Form 10-K filed concurrent with the issuance of this release for greater detail on our results and various company programs.

A conference call has been scheduled for tomorrow, March 1, 2017, at 8:30 AM ET. Listeners may access the call live by telephone at (844) 473-0975 and from outside the U.S. at (562) 350-0826 using the Conference ID: 34153129; or, via the Internet at www.kaman.com. A replay will also be available two hours after the call and can be accessed at (855) 859-2056 or (404) 537-3406 using the Conference ID: 34153129. In its discussion, management may reference certain non-GAAP financial measures related to company performance. A reconciliation of that information to the most directly comparable GAAP measures is provided in this release.

Neal J. Keating, Chairman, President and Chief Executive Officer, commented, “In the fourth quarter of 2016, we continued to execute on our key strategic initiatives to position Kaman for profitable growth. Against a challenging macroeconomic backdrop in certain of our end markets, we are successfully executing on our productivity and realignment programs to enhance margins and consistently deliver improved financial performance. As a key highlight, we are pleased to report gross margin of 31.3% for the quarter, a 310 bps increase over the fourth quarter of 2015 and a 140 bps increase over the third quarter of 2016, primarily driven by improvements at Distribution. Demonstrating our focus on driving meaningful cash flow generation, 2016 was the third consecutive year in which Free Cash Flows* were greater than 130% of our Net Earnings.

Sales in our Distribution segment continued to be impacted by ongoing weakness in our end markets resulting in a 3.2% decrease as compared to the same period last year. Organic Sales per Sales Day* decreased 4.9% for the fourth quarter when compared to the same period last year and declined 3.0% sequentially.

Distribution operating margins in the quarter were 2.2%, a decrease of 30 bps compared to the same period last year. Importantly, this decrease includes the costs associated with the deployment of productivity initiatives designed to expand operating margins, which totaled $4.6 million for the fourth quarter and $12.6 million for the full year 2016. Excluding these costs, Distribution operating margins increased despite lower daily sales levels, which we believe underscores the merits of the actions we are taking. We expect to fully realize the benefits of our productivity initiatives, with significantly lower deployment costs, beginning in 2017.

Our Aerospace segment performed largely in line with our expectations. Sales declined modestly in the fourth quarter; however, sales for the full year increased 17.5%, or 6.9% organically, when compared to the prior year. Strong demand for our missile and bomb fuze products drove organic growth while our bearings products delivered another solid performance throughout 2016. Looking ahead, we will continue to pursue new business opportunities for our fuze products in international markets, where demand remains robust. Aerospace operating margins increased 220 bps when compared to the fourth quarter of the prior year due to improved performance on our structures programs and the contribution from our bearings products.

Prudent, value enhancing acquisitions that strengthen our technology leadership and expand the scope of our product offerings remain a core element of our growth strategy, and we are pleased to report positive performance for our most recent additions. Our acquisitions of EXTEX and GRW continue to perform above expectations and made significant top line contributions while being accretive to earnings per share for the fourth quarter and the full year."

Chief Financial Officer, Robert D. Starr, commented, "In 2016 we delivered strong operating performance and continue to position Kaman for future growth. During the year, we invested $30 million in our operations through the purchase of property plant and equipment, repaid over $20 million in debt, reducing our Debt to Capitalization* ratio by 240 bps to 42.3%, and increased our cash on hand by $25 million. Our robust financial position continues to provide us flexibility to deploy capital to drive value for our shareholders, and in 2016, we returned approximately $33 million of cash to shareholders through our stock repurchase program and dividend payments.

Turning to our 2017 outlook, we expect Aerospace to drive a significant portion of our top line growth, despite continued pricing pressures. We anticipate Aerospace sales increasing in the range of 3.0% to 8.0%, with operating margin in the range of 16.5% to 17.0%. Full year 2017 Aerospace performance is dependent on a number of factors, including the receipt of governmental approvals for direct commercial sales of the JPF to foreign militaries, additional K-MAX orders and continued improvement in the performance of our metallic and composite structures programs.

At Distribution, we expect that 2017 sales levels will range from a decrease of 1.0% at the low end of our range to an increase of 4.0% at the high end, with operating margins in the range of 4.9% to 5.3%. In 2017 we are focused on a return to organic sales growth and are taking necessary actions to achieve this objective, while maintaining disciplined cost control across the segment. Additionally, we expect to more fully realize the benefits of the productivity initiatives we implemented last year as we expect the associated costs to decrease significantly. We are pleased with the meaningful benefit these initiatives have delivered to date and are confident in our ability to achieve further operating margin improvement at Distribution in 2017.

To provide insight into the cadence of earnings for the year, we anticipate a significant portion of our expected earnings will be weighted toward the second half of the year, with first quarter earnings representing less than 10% of our full year earnings. As we move through 2017, we expect earnings to increase sequentially with approximately 50% of our full year earnings occurring in the fourth quarter of 2017 as we anticipate a ramp-up of deliveries for the JPF and our bearings products throughout the year. As previously noted, the delay in receipt of U.S. Government approvals shifted JPF DCS deliveries out of 2016 and into 2017. Further impacting the earnings cadence, we expect that our JPF production capacity for the first nine months of the year will be largely utilized to fulfill our USG contract delivery requirements for 2017. Accordingly, we now anticipate that our higher margin JPF DCS deliveries will mostly occur during the fourth quarter of 2017.

We expect cash flow performance to remain strong in 2017, with cash flows from operations in the range of $105 million to $135 million and Free Cash Flow* in the range of $70 million to $100 million. Given our stable and consistent cash flow generation of the last several years and the expected growth in 2017, we are pleased to announce an 11% increase in our quarterly dividend to $0.20 per share. Kaman has paid a dividend for forty-seven consecutive years, and when combined with our stock repurchase program, underscores our commitment to returning a significant amount of cash to our shareholders."

2017 Outlook

Our 2017 outlook is as follows:

Distribution:

Sales of $1,100.0 million to $1,150.0 million

Operating margins of 4.9% to 5.3%

Depreciation and amortization expense of $16.0 million

Sales of $1,100.0 million to $1,150.0 million

Operating margins of 4.9% to 5.3%

Depreciation and amortization expense of $16.0 million

Aerospace:

Sales of $720.0 million to $760.0 million

Operating margins of 16.5% to 17.0%

Depreciation and amortization expense of $23.0 million

Sales of $720.0 million to $760.0 million

Operating margins of 16.5% to 17.0%

Depreciation and amortization expense of $23.0 million

Interest expense of approximately $16.0 million

Corporate expenses of approximately $55.0 million

Estimated annualized tax rate of approximately 34.5%

Consolidated depreciation and amortization expense of approximately $45.0 million

Capital expenditures of approximately $35.0 million

Cash flows from operations in the range of $105.0 million to $135.0 million; Free Cash Flow* in the range of $70.0 million to $100.0 million

Weighted average diluted shares outstanding of 28.5 million

Dividend Increase

The Kaman Corporation board of directors has declared a regular quarterly dividend of 20 cents per common share, representing an 11% increase, which will be paid on April 6, 2017 to shareholders of record on March 21, 2017.

Please see the MD&A section of the Company's SEC Form 10-K filed concurrent with the issuance of this release for greater detail on our results and various company programs.

A conference call has been scheduled for tomorrow, March 1, 2017, at 8:30 AM ET. Listeners may access the call live by telephone at (844) 473-0975 and from outside the U.S. at (562) 350-0826 using the Conference ID: 34153129; or, via the Internet at www.kaman.com. A replay will also be available two hours after the call and can be accessed at (855) 859-2056 or (404) 537-3406 using the Conference ID: 34153129. In its discussion, management may reference certain non-GAAP financial measures related to company performance. A reconciliation of that information to the most directly comparable GAAP measures is provided in this release.

Mobile Website

Wechat Platform

Wafangdian GuangyangBearing Group Co., Ltd.

Equipment & Capability

Copyright@2017Wafangdian Guangyang Bearing Group Co., Ltd.